Customer Success (CS) software is no longer a “nice-to-have.” In 2025, it’s the foundation of how SaaS companies, subscription services, and even traditional enterprises drive retention, reduce churn, and scale revenue. The right tools help Customer Success Managers (CSMs) monitor customer health, automate onboarding, and identify upsell opportunities — all from a single dashboard.

According to Gartner, companies that deploy advanced customer success platforms see a 15–25% improvement in retention compared to those relying only on CRM or support systems - Gartner 2024 CS Tools Study.

In this guide, we’ll break down what customer success software is, why it matters, and how to choose the right platform for your team.

What Is Customer Success Software?

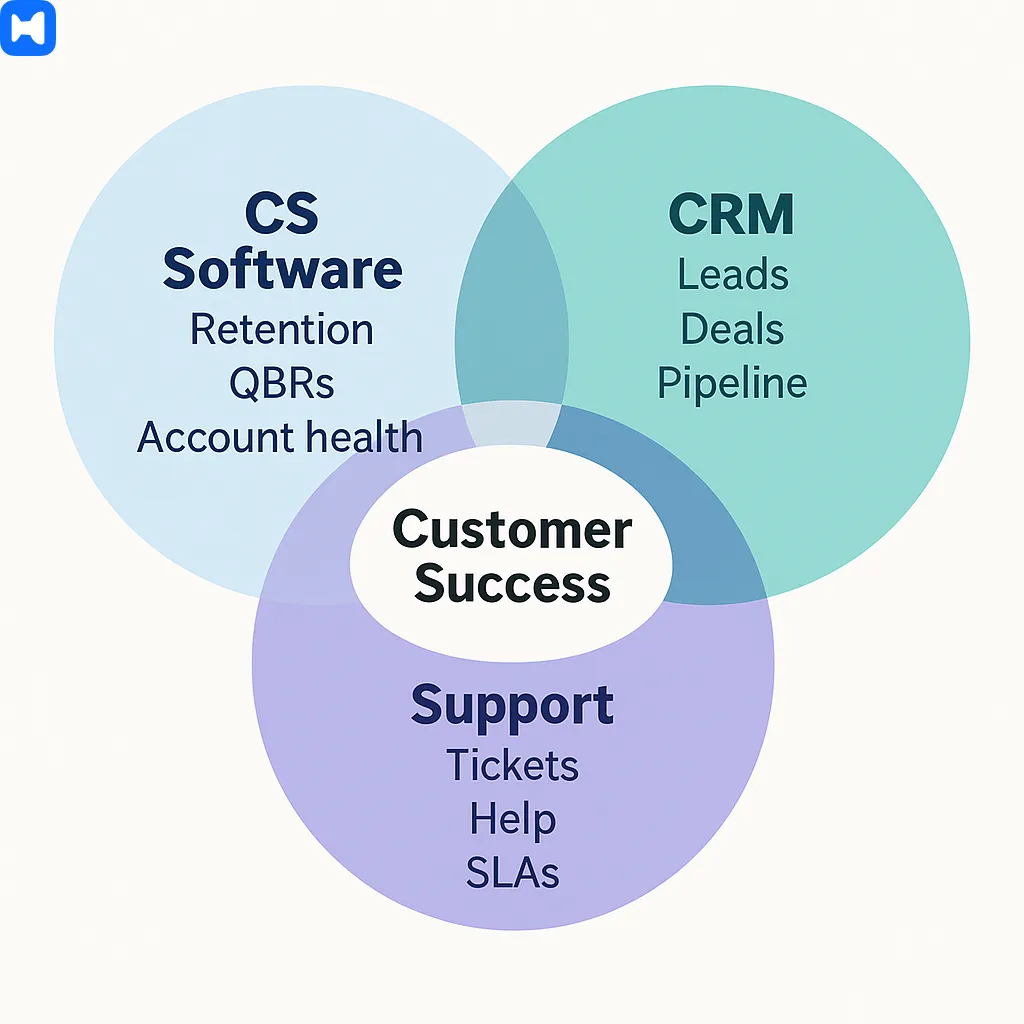

Customer Success Software is a specialized platform that helps businesses manage customer relationships beyond sales and support by focusing on retention, adoption, and long-term value. Unlike CRMs, which track leads and deals, or ticketing tools, which solve problems, CS software is designed to proactively ensure customers achieve their desired outcomes.

Definition and Core Purpose

At its core, customer success software centralizes account data, customer health scores, product usage metrics, and engagement history. It gives CSM teams a real-time view of which accounts are thriving and which are at risk. The goal: predict issues before they lead to churn and drive expansion opportunities at the right moment.

A 2023 Totango survey found that 72% of SaaS businesses use dedicated customer success platforms, up from just 35% in 2018 — showing how quickly the discipline has matured.

How It Differs from CRM and Support Tools

- CRM (e.g., Salesforce, HubSpot): Primarily sales-focused. Tracks leads, opportunities, and revenue pipeline.

- Support tools (e.g., Zendesk, Freshdesk): Reactive. Handle tickets and issue resolution.

- Customer Success platforms (e.g., Gainsight, Totango, ChurnZero, Wellpin): Proactive. Measure adoption, automate playbooks, monitor account health, and scale CSM efforts.

Think of it this way: CRM closes the deal, support solves the issue, but CS software makes sure the customer stays and grows.

Why Companies Invest in Customer Success Platforms

Companies don’t just buy these tools for dashboards. They invest because:

- Churn prevention = higher recurring revenue.

- CSMs can manage 3–5x more accounts with automation.

- Consistent customer experience improves Net Promoter Scores (NPS) and referrals.

“If you’re only using CRM and ticketing, you’re missing the middle — the customer journey post-sale. That’s where CS software pays for itself within a year.” — Forrester Analyst, 2024.

Key Features of Customer Success Tools

The best customer success platforms share a core set of features: customer health scoring, automated workflows, product usage analytics, onboarding playbooks, and integrations with CRM and support systems. These tools help Customer Success Managers (CSMs) manage accounts at scale, prevent churn, and identify upsell opportunities.

1. Customer Health Scoring

- Tracks adoption, engagement, and support history.

- Uses weighted metrics (logins, feature usage, open tickets, survey responses) to assign a score (e.g., Red/Yellow/Green).

- Helps CSMs prioritize at-risk accounts before they churn.

According to ChurnZero’s 2024 Benchmark Report, companies that actively use health scoring models reduce churn by up to 27% compared to those relying on ad-hoc tracking.

2. Automated Playbooks

- Standardizes actions like onboarding sequences, renewal reminders, or expansion triggers.

- Reduces manual work so each CSM can manage 3–5x more accounts.

- Examples: automatic NPS survey after onboarding, or renewal workflow 90 days before contract end.

3. Product Usage Analytics

- Connects to product telemetry to show how customers are (or aren’t) engaging with key features.

- Identifies power users, inactive users, and adoption bottlenecks.

- Critical for SaaS, where feature adoption drives renewal.

“Product usage data is the single most predictive factor for churn. If you’re not tracking it in your CS platform, you’re flying blind.” — SaaS Metrics Analyst, 2024.

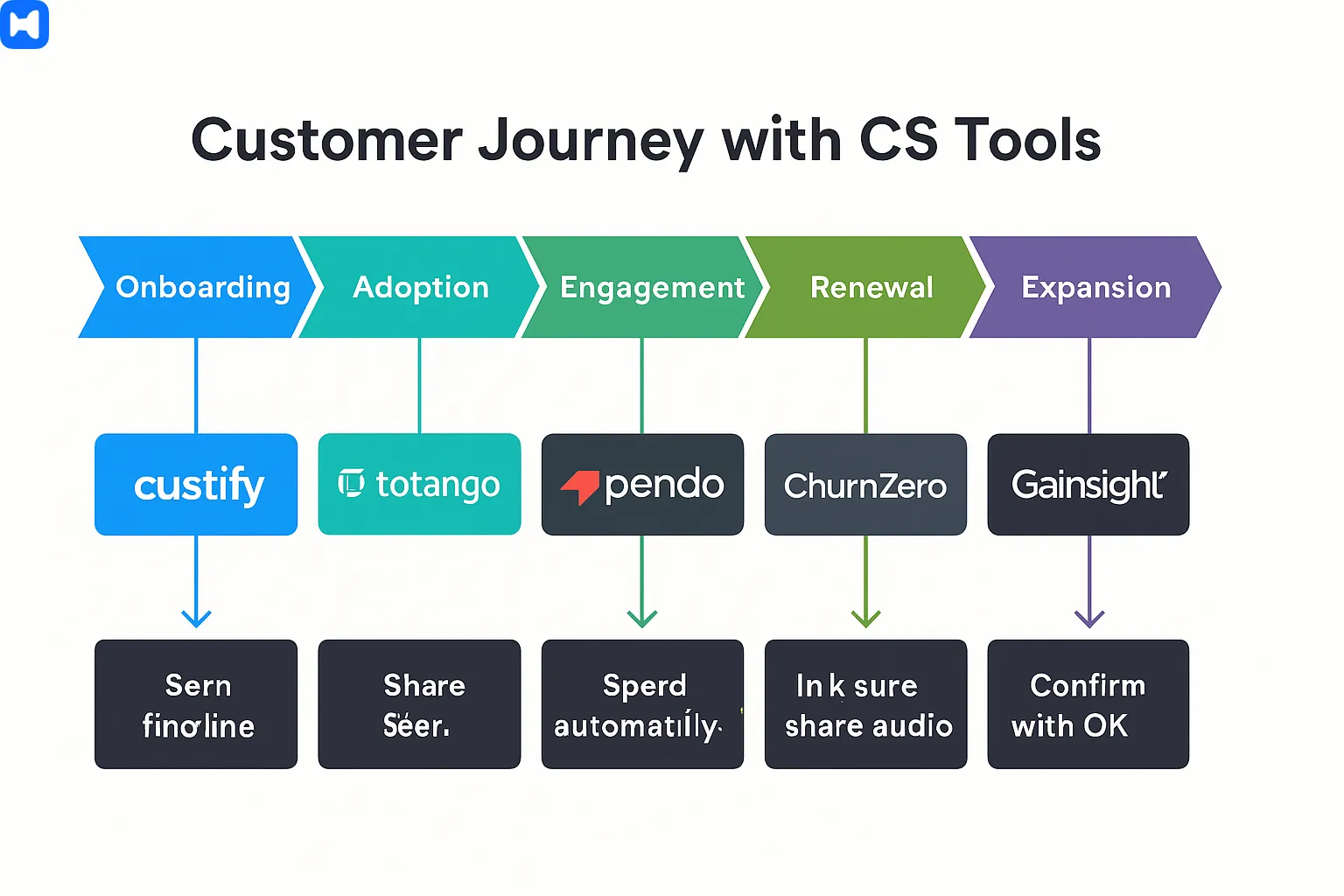

4. Onboarding and Customer Journeys

- Customizable onboarding templates to guide new clients step by step.

- Journey maps to track milestones like “First Value,” “Adoption,” “Renewal.”

- Keeps the customer lifecycle transparent for both CSMs and clients.

5. Integrations with CRM, Support & Billing

- Syncs with Salesforce, HubSpot (CRM).

- Connects to Zendesk, Freshdesk (support).

- Pulls renewal data from billing tools (Stripe, Chargebee).

- Ensures a 360° view of the customer.

6. Reporting and Success Analytics

- Dashboards for churn rate, Net Revenue Retention (NRR), expansion revenue.

- Custom reports for board meetings and QBRs.

- Benchmarks to measure CSM performance.

Gainsight’s Pulse Report (2024) showed that companies with mature CS reporting achieve 120%+ Net Revenue Retention (NRR), while laggards average 95%.

Best Customer Success Platforms (2025): Quick Comparison

Feature Matrix: Comparing Core Capabilities of Customer Success Software

How to Choose the Right Customer Success Platform

Choosing between 10+ platforms can feel overwhelming — they all promise “customer health,” “automation,” and “retention.” The reality? The best tool depends on your company’s size, maturity, and customer engagement model.

For SMBs and Startups

If you’re a small team with under 10 CSMs, you need something simple, fast to deploy, and not enterprise-priced.

- Custify and Vitally stand out here: both offer built-in usage analytics, automation, and easy onboarding without a six-month implementation project.

- ClientSuccess also fits smaller teams that want clarity over complexity.

SMB-friendly CS platforms typically cut onboarding time in half compared to enterprise CS suites (G2 2024 data).

For Mid-Market Companies

Growing SaaS companies with 20–50 CSMs usually need more structure: playbooks, health scoring, renewal alerts, and reporting.

- Totango and Planhat shine in this segment, thanks to flexible automation and broad integrations.

- ChurnZero is a popular choice for SaaS teams that want digital CS (automated touchpoints for long-tail accounts).

According to Forrester, mid-market companies using automation-first CS platforms report a 20–30% faster response to churn risks compared to manual processes.

For Enterprises

Large organizations care about compliance, scalability, and deep analytics.

- Gainsight CS is the undisputed heavyweight, with advanced health modeling, renewal forecasting, and broad adoption across Fortune 500 companies.

- Salesforce Service/Success Cloud is ideal if your entire GTM motion already lives inside Salesforce.

- Zendesk + add-ons work for enterprises that want to unify support + success but don’t need deep renewal forecasting.

Enterprise CS suites often include compliance-grade reporting — a must for industries like finance and healthcare. Gartner notes that 60% of enterprises now use CS platforms primarily to ensure compliance and risk visibility, not just retention.

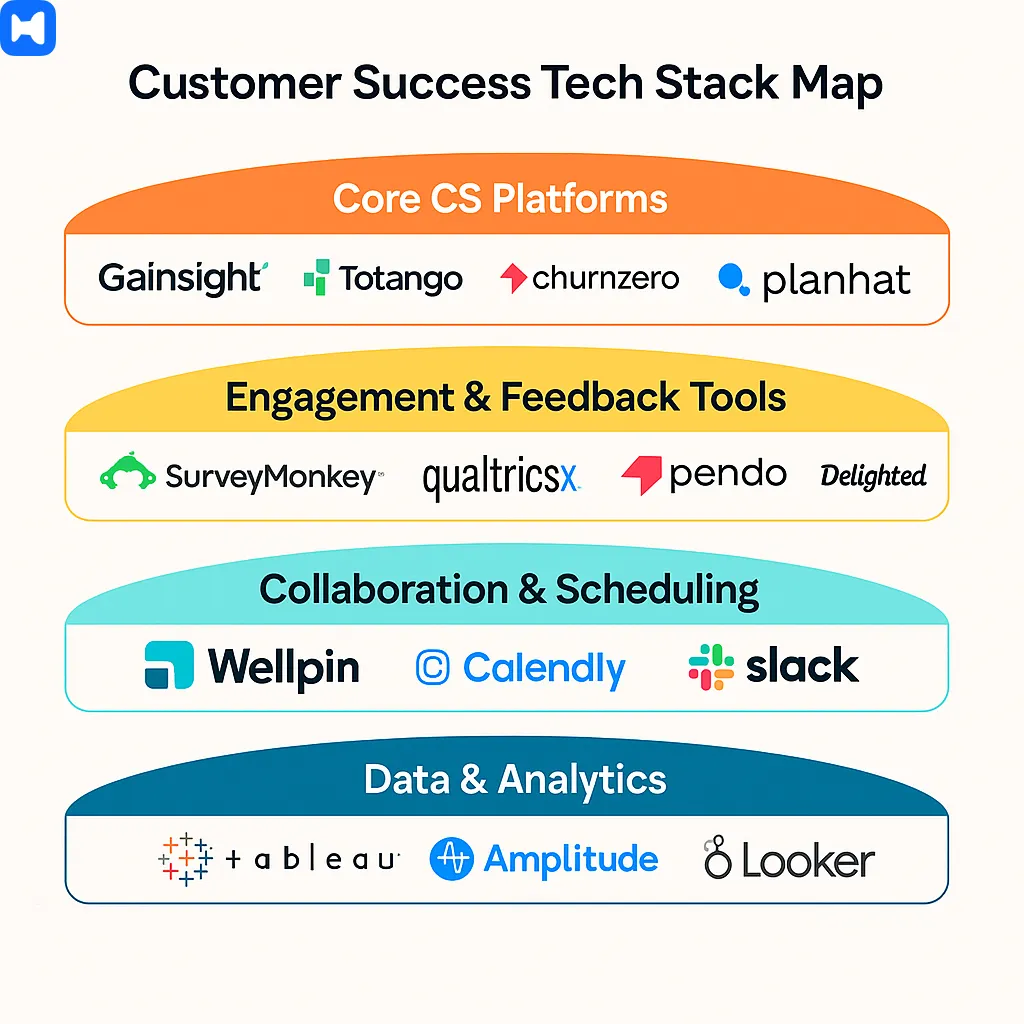

Practical Tip: Stack, Don’t Replace

Customer Success software isn’t a silver bullet. Most teams end up with a CS “tech stack” that layers:

- Core CS platform (e.g., Gainsight, Totango, Custify)

- Product analytics (Pendo, Amplitude, Mixpanel)

- NPS/feedback tools (Qualtrics, Delighted)

- Scheduling & collaboration (Wellpin, Calendly, Google Workspace)

This layered approach ensures both high-touch engagement and scalable digital CS.

Best-in-Class Customer Success Software in 2025

Not every company needs Gainsight-level complexity or Totango’s enterprise automation. Here’s a breakdown of which tools fit best depending on your size, goals, and customer motion.

Best for SMBs and Startups

- Custify → Fast onboarding, intuitive dashboards, built-in product usage analytics.

- Vitally → Easy automation + strong playbooks for SaaS startups scaling quickly.

- ClientSuccess → Simple, clear design for teams who want a lightweight but structured approach.

These tools typically reduce time-to-value by 50% compared to enterprise CS suites (G2, 2024).

Best for Mid-Market SaaS

- Totango → Modular “SuccessBLOCs” make it easy to scale structured customer journeys.

- ChurnZero → Great for digital CS and long-tail customer automation.

- Planhat → Flexible customization, perfect for companies with mixed B2B/B2C models.

Forrester reports that mid-market CS teams using automation-first platforms see 20–30% faster churn detection.

Best for Enterprises

- Gainsight CS → The gold standard for large-scale CS organizations; deep health scoring and renewal forecasting.

- Salesforce Service/Success Cloud → Seamless if your org already runs entirely on Salesforce.

- Zendesk Suite (CS adaptation) → Ideal if you’re heavily support-driven and want CS layered on top.

According to Gartner (2024), 60% of enterprises use CS platforms primarily for compliance and risk management, not just churn.

Best for AI-Powered CS

- Gainsight PX + CS → AI-driven forecasting and sentiment analysis.

- Totango Unison AI → Real-time insights into customer journeys.

- Vitally + integrations → Easier entry-level AI, with usage-based triggers.

AI is not replacing CSMs — but it’s helping teams manage 5–10x more accounts through predictive health scoring and auto-playbooks.

Best for Building a CS Tech Stack

- Core CS Platform → Gainsight / Totango / Custify

- Product Analytics → Pendo / Amplitude

- Voice of Customer (NPS/Surveys) → Qualtrics / Delighted

- Scheduling & Collaboration → Wellpin (for QBR/EBR and customer calls)

The magic happens when these tools work together, not when you try to squeeze everything into one platform.

Pricing Models and Cost Considerations

Choosing the right customer success software isn’t only about features — pricing plays a huge role. The market is split between transparent SMB-friendly pricing and enterprise quote-based contracts, and the gap between them can be massive.

Common Pricing Models

- Per-Seat Licensing: You pay per Customer Success Manager (CSM) or admin. Popular in SMB/mid-market tools like Custify or HubSpot Service Hub.

- Tiered Feature Plans: Entry tiers give basic playbooks and health scores; higher tiers unlock AI forecasting, deep analytics, or enterprise integrations.

- Usage-Based Pricing: A few platforms tie cost to active customers/accounts managed (e.g., some Totango packages).

- Enterprise Contracts: Gainsight, Salesforce, and similar players bundle features into annual contracts that scale with company size and integrations.

Typical Cost Ranges (2025)

- SMB Platforms (Custify, Vitally, ClientSuccess):

$25–$150 per user/month, often with minimums of 3–5 seats. - Mid-Market Platforms (Totango, ChurnZero, Planhat):

From ~$20k to $60k annually, depending on number of seats and integrations. - Enterprise Platforms (Gainsight, Salesforce, Medallia):

$50k–$150k+ per year; large deployments often hit six figures.

According to G2 reviews, the median annual spend for enterprise CS platforms is around $60k–$75k, while SMB teams typically spend under $10k/year.

Hidden Costs to Watch For

- Implementation Fees: Some enterprise CS tools charge professional services for setup (often $5k–$20k).

- Integration Overhead: Connecting CRM, product analytics, and billing systems may require custom dev or middleware.

- Training & Change Management: Gainsight and Salesforce often need dedicated admins; SMB tools usually don’t.

- Renewals and Scaling: Adding more seats or modules (e.g., AI or PX add-ons) can double your contract cost.

Always factor in the time-to-value. A $5k/month platform that takes 9 months to implement may actually cost more in lost opportunity than a $10k/year SMB platform you can launch in 2 weeks.

Customer Success Tech Stack Examples

No customer success platform works in isolation. The most effective CS teams build a tech stack that connects CRM, product usage, scheduling, and customer feedback into one flow. Here’s how stacks typically evolve by company size.

SMB Stack (Lean & Fast to Deploy)

- Core CS Platform: Custify or Vitally → usage analytics + automation in one.

- CRM: HubSpot (affordable, easy integrations).

- Support: Intercom or Zendesk (starter tiers).

- Scheduling: Wellpin for customer calls, onboarding sessions, and quarterly check-ins.

- NPS / Feedback: Delighted (simple, low-cost).

Keeps costs under $10k/year, gets you health scores + automations + basic customer feedback without enterprise overhead.

Mid-Market Stack (Scalable + Structured)

- Core CS Platform: ChurnZero, Totango, or Planhat.

- CRM: Salesforce or HubSpot Pro.

- Product Analytics: Pendo or Amplitude for detailed usage insights.

- Support: Zendesk Suite for omnichannel.

- Scheduling & Collaboration: Wellpin for QBR/EBR scheduling, automated reminders, file-sharing with customers.

- NPS / Feedback: Qualtrics or InMoment.

Forrester notes that mid-market SaaS companies using structured CS stacks reduce churn by 10–15% compared to CRM-only setups.

Enterprise Stack (Advanced + Compliance-Ready)

- Core CS Platform: Gainsight CS + PX for health scoring + product adoption.

- CRM: Salesforce Service Cloud (deep integration with CS).

- Product Analytics & Digital Adoption: Pendo, WalkMe, or Mixpanel.

- Support: Zendesk Enterprise or Freshdesk Omnichannel.

- Scheduling & Governance: Wellpin for complex multi-stakeholder scheduling across regions and time zones.

- NPS / VoC: Medallia or Qualtrics with enterprise-grade compliance.

- Data Layer: Snowflake or BigQuery + reverse ETL (Hightouch/Census) to unify health scoring.

Enterprises need compliance-grade reporting and renewal forecasting. According to Gartner, 60% of enterprises now buy CS software primarily for risk visibility and compliance.

These stack templates can be turned into a visual diagram infographic (three tiers: SMB → Mid → Enterprise, with logos).

Fact Check: Why Customer Success Software Matters

Sometimes features and pricing don’t tell the whole story. Numbers do. Here are evidence-based insights from industry research:

- Net Revenue Retention (NRR): companies that adopt a dedicated CS platform report 27% higher NRR compared to those relying only on CRM + spreadsheets (Forrester, 2024).

- Churn Reduction: G2 survey data shows that mid-market SaaS companies using structured CS tools experience 10–15% lower annual churn.

- Time-to-Value: according to ChurnZero benchmark data, SMB-friendly CS platforms can cut onboarding time by 50% compared to enterprise CS suites.

- Tech Stack Complexity: Gartner predicts that by 2026, 70% of B2B SaaS companies will maintain a multi-layer CS stack (platform + analytics + VoC + scheduling), not a single all-in-one solution.

- Compliance Factor: for enterprises, Gartner highlights that 60% of CS investments are justified by compliance and risk visibility, not just retention goals.

- AI Adoption: gainsight and Totango report that early AI-driven forecasting has helped CS teams handle 5–10x more accounts per CSM without reducing customer engagement.

Customer success software isn’t just about making CSMs more efficient. It directly ties to revenue, retention, and compliance — the metrics CEOs and CFOs actually care about.

Expert Insights on Customer Success Software

“Customer Success isn’t about dashboards — it’s about alignment. The right software should free up your CSMs to spend more time with customers, not less.”

— VP of Customer Experience, SaaS Unicorn (2025)

Pro Tips for Maximizing Your CS Platform

- Start simple, scale later: Don’t overbuy. SMBs often implement Gainsight or Salesforce too early, then struggle with admin costs.

- Automate the repeatable: Use playbooks and automated triggers for onboarding emails, renewal reminders, and low-touch accounts — but keep high-value customers human-first.

- Integrate with product data: Adoption signals (from Pendo, Amplitude, Mixpanel) often predict churn earlier than NPS.

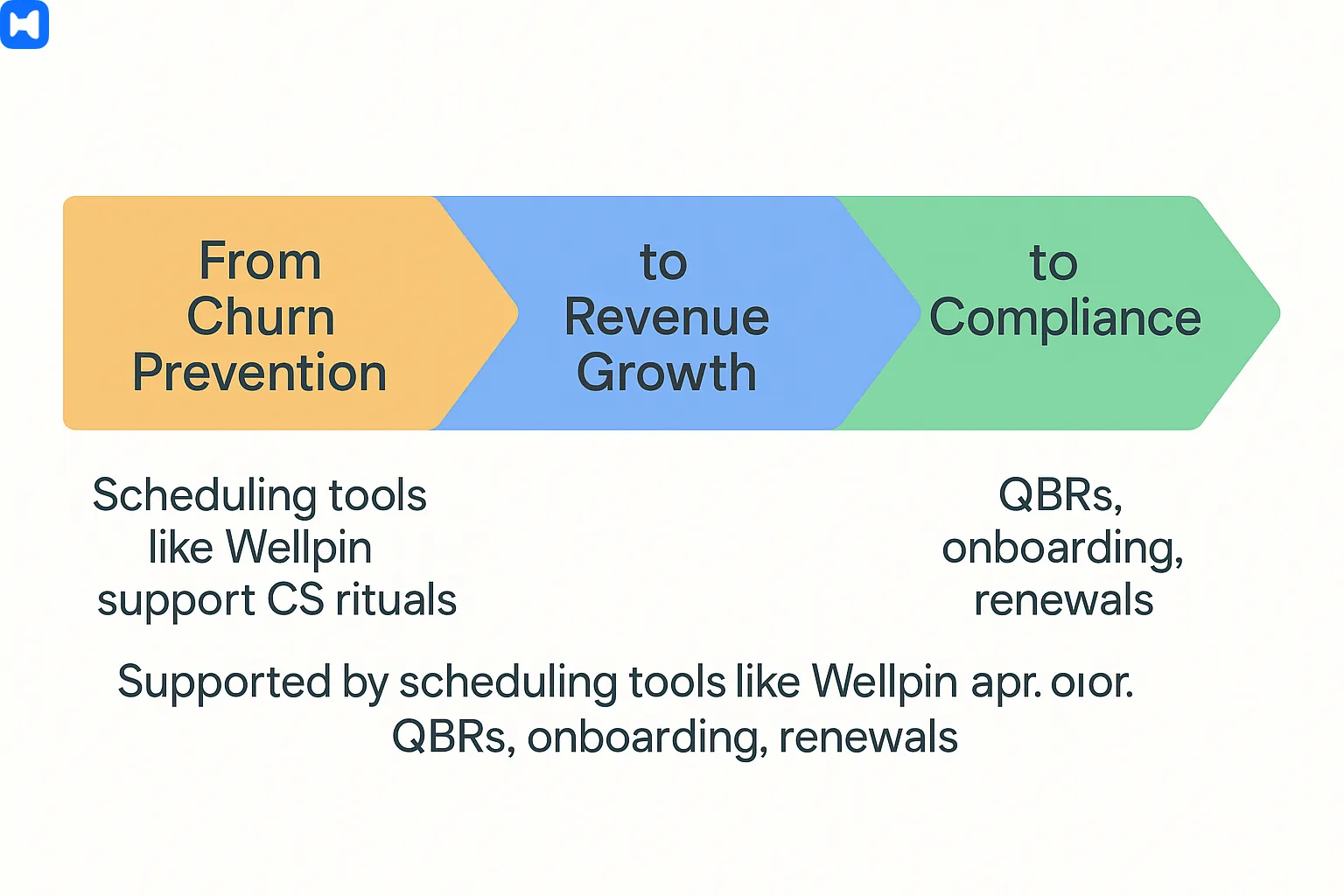

- Standardize your QBRs/EBRs: Tools like Wellpin help align time zones, automate reminders, and attach pre-read docs, ensuring exec meetings actually happen.

- Measure what matters: Focus on Net Revenue Retention (NRR) and Customer Health Scores — not vanity metrics like ticket volume alone.

“Speed and clarity are the hidden currencies of customer success. Platforms that make it easy to communicate availability and next steps are worth their weight in gold.”

— CS Operations Lead, Fortune 500 SaaS

Conclusion: Turning Customer Success Into a Growth Engine

Customer Success isn’t just about preventing churn anymore — it’s become a strategic driver of revenue, retention, and trust. The right platform can transform how your team works, but the real key lies in choosing tools that match your size and maturity.

- SMBs benefit from lightweight, intuitive tools like Custify, Vitally, or ClientSuccess.

- Mid-market teams need structure and automation, making Totango, ChurnZero, and Planhat ideal fits.

- Enterprises require scalability, compliance, and forecasting — where Gainsight and Salesforce dominate.

At the same time, software isn’t a magic fix. Misclassification of roles, poor onboarding, or disconnected workflows can still derail your efforts. That’s why a layered tech stack — combining a CS platform with analytics (Pendo, Amplitude), feedback (Qualtrics, Delighted), and scheduling (Wellpin, Calendly) — often delivers the best results.

Research from Forrester and Gartner is clear: companies with dedicated CS platforms see double-digit improvements in Net Revenue Retention and lower churn across every segment. But the real differentiator? How well you align technology with human judgment and customer touchpoints.

Customer success software is most powerful when it supports — not replaces — authentic relationships. Tools like Wellpin help CS teams handle the scheduling grind, freeing them to focus on what actually matters: building trust, guiding customers to value, and turning accounts into long-term partners.

.webp)